Articles

A Quick Guide To Non-bank Property Development Financing

Gain an understanding of why non-bank financing has become an increasingly important option for property developers in Australia.

Navigating The Property Buying Landscape: Choices And Considerations

Understand the key differences between buying a house and land package, building from scratch and buying an established property.

Why Australia Needs Sustainable Property Developments

Learn why Australia needs sustainable property developments and read about four established and emerging green projects.

Understanding Capitalised Interest, Interest In Advance And Prepaid Interest

Learn the pros and cons of capitalised, advance and prepaid interest to choose the best financing option for your project.

Detailed Overview Of Progress Claims In Construction

Learn what progress claims are, how they’re processed and how lenders assess them to manage property development projects effectively.

8 Risks To Successful Property Development Financing

Understand the type of risks lenders evaluate when they consider financing a property development project and what developers can do to mitigate them.

Navigating Financial Shortfalls In Construction

Learn how developers navigate financial shortfalls in construction through planning, cost control and creative funding strategies.

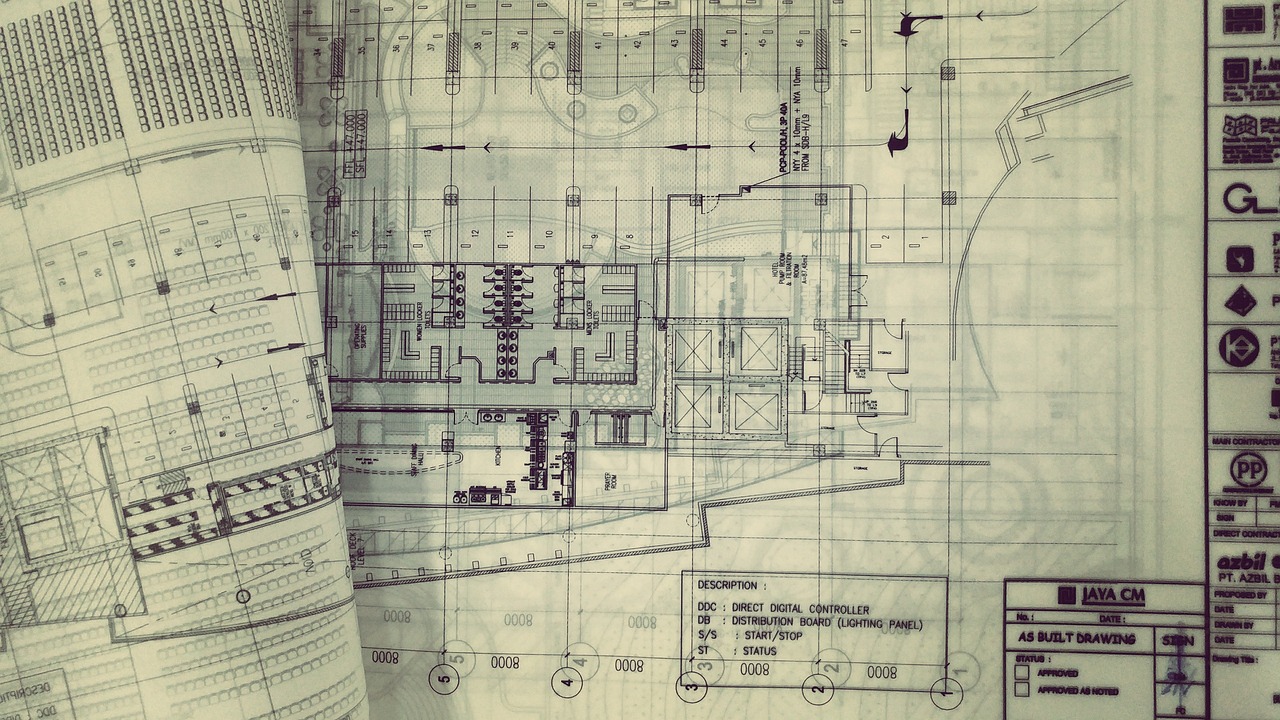

What Are Feasibility Studies In Property Development

Understand the role of feasibility studies in property development and how they can assist with successful project completion.

Mortgages For Developers: Smart Advantages

Mortgages help property developers improve cash flow, gain tax benefits and seize market opportunities for greater project success.

Property Valuations: Key Factors For Market Value & Development

Learn about property valuations and how different different approaches and inputs feed into the valuation report.

Comprehensive Guide To The Role Of Quantity Surveyors In Construction Projects

Understand the critical role quantity surveyors play in managing construction projects from start to finish.

Quick Guide To The Benefits And Risks Of Negative Gearing

Discover the benefits and risks of negative gearing in the Australian property market to make informed investment decisions.